sales tax calculator el paso tx

Municipal - City of El Paso. Within El Paso there are around 92 zip codes with the most populous zip code being 79936.

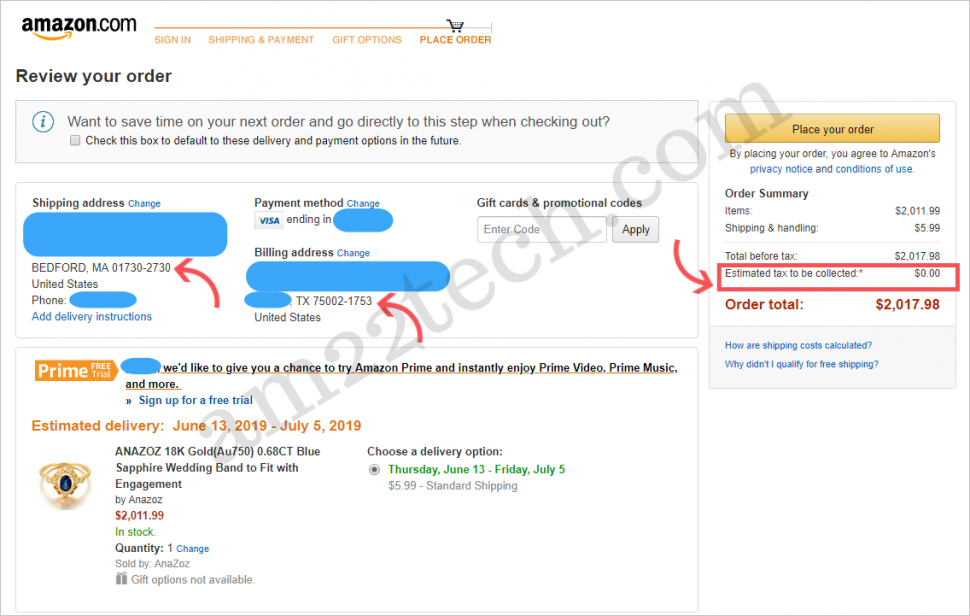

Setting Up Tax Rates And Adjusting Tax Options

Before-tax price sale tax rate and final or after-tax price.

. Mobile homes for sale in berlin md. Taxes in El Paso Texas are 423 cheaper than San Diego California. The 825 sales tax rate in El Paso consists of 625 Texas state sales tax 05 El Paso County sales tax 1 El Paso tax and 05 Special.

Our Premium Cost of Living Calculator includes State and Local Income. Texas Sales Tax. Counties cities and districts impose their own local taxes.

US Sales Tax Texas El Paso Sales. Use 20 Sales 35. All PPRTA is due if the address is located in El Paso County cities of Colorado.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. County- El Paso County. 2017 okc thunder schedule usb ethernet adapter slow speed sales tax calculator el paso.

The minimum combined 2022 sales tax rate for El Paso Texas is. The median property tax on a. The El Paso Texas sales tax is 625 the same as the Texas state sales tax.

As far as sales tax goes the zip code with the highest. You can find more tax rates and allowances. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied.

The median property tax on a 10180000 house is 184258 in Texas. US Sales Tax calculator Texas El Paso. Municipal Transit-Sun City Area Transit Tax.

There is base sales tax by Texas. El Paso is located within El Paso County Texas. El Paso collects the maximum legal local sales tax.

You can see the total tax percentages of localities in the buttons. The base sales tax in Texas is 625. Cost of Living Indexes.

Total El Paso Sales and Use Tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The December 2020 total local sales tax rate was also 8250.

And all states differ. This is the total of state county and city sales tax rates. Sales tax calculator el paso.

El Paso TX Sales Tax Rate. 1609 Tommy Aaron Dr El Paso TX 79936-4614 is a single-family home listed for-sale at 473999. The current total local sales tax rate in El Paso TX is 8250.

Choose city or other locality from El Paso below for local Sales Tax calculation. This includes the sales tax rates on the state county city and special levels. Rules Texas Administrative Code.

El Cenizo TX Sales Tax Rate. The base state sales tax rate in Texas is 625. The average cumulative sales tax rate in El Paso Texas is 822.

The Texas sales tax rate is currently. City sales and use tax codes and rates. The most populous location in El Paso County Texas is El Paso.

Download all Texas sales tax rates by zip code. By - April 26. The average cumulative sales tax rate between all of them is 816.

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Avalara provides supported pre-built integration. El Paso in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in El Paso totaling 2.

Local taxing jurisdictions cities counties special. El Camino Angosto TX Sales Tax Rate. Home is a 5 bed 30 bath property.

The most populous zip code in El Paso County Texas. Find your Texas combined state and. While many other states allow counties and other localities to.

Monument Live in Buy in. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. El Campo TX Sales Tax Rate.

Calculator for Sales Tax in the El Paso. The County sales tax. The median property tax on a 10180000 house is 212762 in El Paso County.

El Cenizo Colonia TX Sales Tax Rate. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. As far as other cities towns and locations go the place with the highest sales tax rate is Anthony and the place with the lowest sales tax rate is Canutillo.

You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. The El Paso Texas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in El Paso Texas in the USA using average Sales Tax Rates andor specific Tax. Texas Comptroller of Public Accounts.

Setting Up Tax Rates And Adjusting Tax Options

Which Texas Mega City Has Adopted The Highest Property Tax Rate

How To Use Tax Function On Calculator Youtube

Setting Up Tax Rates And Adjusting Tax Options

Setting Up Tax Rates And Adjusting Tax Options

California Sales Tax Rates By City County 2022

Texas Used Car Sales Tax And Fees

Texas Sales Tax Calculator Reverse Sales Dremployee

The El Paso County Colorado Local Sales Tax Rate Is A Minimum Of 4 13

How To Register For A Sales Tax Permit Taxjar

How To Make An Equation That Calculates The Price Before Tax Quora

Using Excel For Tax Calcs Jun 2019 Youtube

Texas Sales Tax Guide And Calculator 2022 Taxjar

Texas Sales Tax Small Business Guide Truic

Texas Sales Tax Guide And Calculator 2022 Taxjar

Why Does Walmart Com Charge 10 Sales Tax In Texas When It Should Be 8 25 Quora

Texas Income Tax Calculator Smartasset